High-Income Realty Buying New York City: Maximizing Your Returns

Purchasing realty is a reliable method for building wide range, and for those wanting to take it to the next degree, high-income real estate investing in New York provides an amazing chance. New York, with its dynamic economic climate, global condition, and diverse realty market, supplies various methods for financiers to create substantial revenue. From the dynamic metropolis of New york city City to the growing chances in Upstate New York, high-income realty investments can provide excellent returns when come close to strategically.

In this article, we'll check out the crucial approaches, markets, and residential property types that can help you succeed in high-income property investing in New york city.

Why Invest in New York City Property?

New york city has long been a magnet for real estate investors because of its diverse economic climate, high demand for rental homes, and potential for significant appreciation. Trick reasons to consider high-income property investments in New york city include:

Solid rental market: With a big population, high need for real estate, and restricted room in lots of urban locations, rental residential or commercial properties in New york city are often in short supply, increasing rental rates.

High gratitude possibility: Residential or commercial property worths in New york city, particularly in the 5 districts of New York City, have a tendency to value with time, creating long-lasting wide range for capitalists.

Diverse market choices: From deluxe apartments in Manhattan to commercial real estate in Upstate New York, the state provides a variety of financial investment opportunities, allowing investors to diversify their portfolios.

Ideal Markets for High-Income Real Estate in New York City

New york city supplies a series of successful property markets. Several of the very best locations for high-income real estate investing consist of:

1. New York City City

New York City is just one of one of the most competitive and rewarding real estate markets in the world. Capitalists can capitalize on:

Deluxe leasings: Manhattan, particularly, is home to high-end homes and condominiums that attract wealthy renters willing to pay premium rental fees.

Multifamily residential properties: The city's high population density and continuous need for housing make multifamily buildings (such as apartment buildings) a reliable source of revenue. Boroughs like Brooklyn and Queens provide outstanding possibilities for multifamily investments, commonly with reduced acquisition expenses than Manhattan.

Business real estate: NYC's successful downtown create sufficient chances for business property investments. Office spaces, retail homes, and mixed-use advancements can produce strong cash flow because of long-lasting leases and high demand.

2. Upstate New York

While NYC is known for its sky-high rates, Upstate New york city provides a more budget-friendly choice for financiers seeking high-income opportunities. Cities like Albany, Syracuse, and Buffalo are experiencing revitalization, with development in populace, job possibilities, and property demand. Trick chances include:

Value-add homes: In cities like Albany and Buffalo, investors can discover value-add residential or commercial properties-- older homes or structures that can be remodelled and boosted to enhance worth. These residential or commercial properties are generally a lot more cost effective than in New York City, however they still offer considerable returns after improvements.

Holiday services: In areas like Saratoga Springs, Lake George, and the Finger Lakes, temporary and trip rentals remain in high need during peak seasons, giving investors with chances to make greater rental income with systems like Airbnb.

Approaches for High-Income Real Estate Purchasing New York City

1. Focus on Multifamily Characteristics

Purchasing multifamily buildings is one of the most efficient means to create high income from real estate. In New York, multifamily residential properties are specifically eye-catching due to the demand for housing in both urban and suburban areas. With several occupants paying rental fee, these buildings provide multiple streams of earnings, and the danger of job is lessened since even if one system is uninhabited, others are still producing profits.

In neighborhoods throughout Brooklyn and Queens, multifamily residential properties remain to value as demand for housing grows, making them a solid choice for investors.

2. Discover Short-Term Rentals in Visitor Locations

Temporary leasings, particularly with platforms like Airbnb and VRBO, can yield considerably higher income than lasting services, especially in high-demand vacationer areas of New York. Properties in locations such as Saratoga Springs, the Hamptons, and Niagara Falls are exceptional candidates for short-term services, as they bring in site visitors throughout the year.

When purchasing short-term services, think about the following:

Place: Choose buildings near major attractions, occasions, and facilities to ensure regular reservations.

Management: Temporary leasings require even more hands-on management, so working with a residential property administration firm can assist streamline procedures and guarantee a favorable guest experience.

3. Buy Industrial Property

For financiers looking for high-income chances, commercial realty can be highly rewarding. Office spaces, retail residential properties, and industrial structures in areas with economic growth can create considerable rental earnings due to long-term leases and greater rental fee rates. New york city City's business real estate market uses some of the highest rental returns in the nation, but smaller sized cities in Upstate New york city, like Albany and Rochester, also existing solid chances for business investment.

4. Usage Utilize Wisely

Take advantage of, or utilizing obtained resources to fund your real estate financial investment, is a effective device in high-income real estate investing. In New York, where residential property rates can be high, using a home loan can enable capitalists to acquire residential or commercial properties that may or else run out reach. Nonetheless, it's essential to guarantee that the rental earnings covers the home loan and various other expenditures, giving positive cash flow.

By using leverage strategically, you can maximize your return on investment and boost your profile's making capacity without binding all of your capital in one home.

5. Take Into Consideration Luxury and High-End Feature

Luxury buildings in areas like Manhattan and the Hamptons commonly command top dollar in both rental and resale value. High-net-worth individuals agree to pay costs prices for high-end homes, condos, and houses, making this market among one of the most profitable in real estate.

https://sites.google.com/view/real-estate-develop-investment/ High-end residential properties usually appreciate faster than other segments, and because they cater to wealthy tenants, they can command a lot higher rental fee rates. Capitalists in this market need to focus on delivering high-end facilities, such as modern coatings, attendant services, and prime locations, to bring in wealthy renters.

High-income real estate investing in New york city supplies amazing opportunities for capitalists seeking to optimize returns. Whether you're targeting high-end services in Manhattan, multifamily residential properties in Brooklyn, or short-term holiday rentals in Upstate New york city, there are strategies to fit various budget plans and objectives. By focusing on prime places, leveraging the appropriate opportunities, and carrying out effective administration methods, you can transform your New York realty financial investment right into a reliable source of high income.

Purchasing New york city's thriving and diverse realty market can bring about long-lasting riches and monetary success. With the right method and market understanding, you can open the full capacity of high-income realty investing in the Realm State.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Kel Mitchell Then & Now!

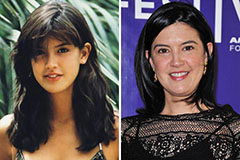

Kel Mitchell Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!